In the times when almost all emerging, as well as developed nations, are worried about a potential recession, India’s expectation of growth in GDP is much talked of. In a recent interview, India’s minister of state for civil aviation said that India’s economy is “well positioned” for showing a decent growth as factors like government debt and mild inflation are at play. Minister Jayant Sinha also said that the two most significant factors for the Indian economy are oil prices and monsoon timings.

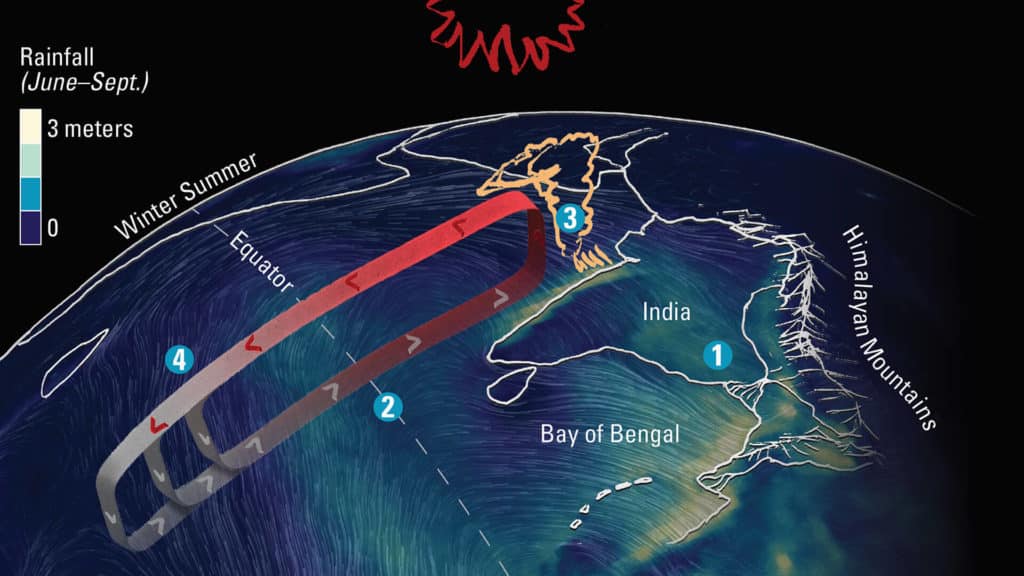

According to Minister Sinha, if there is an adverse movement over the oil prices, a robust expected monsoon will bring the growth India’s economists have predicted. He expects a growth rate of over 8 to 9 percent for 2019. In India, significant fiscal policies by the Government as well as monetary policies by the Central Bank have aimed at mitigating these two factors.

It should be noted that India is a major importer of oil and recently it has aligned its domestic oil prices with the international crude prices. India’s economy is still much dependent on the farmers, though it has grown its tertiary sector in recent years exponentially. So, a lot depends on the movement of monsoon in the Indian economy.

Everything is not rosy for Indian farmers. They have been struggling for years for low procurement prices, droughts and traditional farming process. The current government takes the two major steps, GST and Demonetisation also aimed at easing the stress on them, but the results are yet to be ascertained.

Growth Rate-

As per the reports by the CSO (Central Statistics Office), the growth rate in the financial year 2018 has slowed down. As far as the growth in the last month of 2018 is concerned, it noticed a rate of 6.6 percent with a comparison to December 2017. The growth rate for the first quarter of 2018 was 8 percent.

As far as the predictions by the CSO is concerned, India will have a growth rate of 7 percent at the time other emerging nations are expecting a growth of around 6 percent only.

“And then there’s one additional point which is very important,” Sinha added. “India is not an over-leveraged economy. If you look at our debt-to-GDP ratio, for the overall economy, that is in the 140-150 percent debt-to-GDP, and that includes all kinds of debt.”

Debt-to-GDP ratio is a major indicator for the economies as it shows the capability of the countries to pay its debt back. It shows the country’s total debt in a percentage of the country’s GDP. India is having the edge over this indicator as other major economies are hovering around 200 to 300 percent. China has a 247 percent debt over its GDP.

Sinha said with an aim at the investment that India’s economy is expected to grow around 7 to 7.5 percent the next year, and it is considered as a good sign for the investors. He said, “As investment levels start to increase, as we continue to be in this macroeconomic sweet spot, we are going to accelerate further when it comes to growth. We are very, very well-positioned as far as growth is concerned in India.”

Leave a Reply